ZackDaniels

Well-Known Member

This is going to be a running narrative in the news for the rest of the year and so I figured I'd give a summary of what is being discussed. I'm trying my best to keep opinions out of this and give a 'just the facts' summary.

How did we get here?

Last year when the debt ceiling was about to be hit and Obama and Congress got into a yelling match about if it would be allowed to raise or not. Ultimately the compromise was Obama would get his debt ceiling raise, but only if the Budget Control Act would be allowed in.

The Budget Control Act (BCA) is full of dramatic cuts that neither side wants, including deep cuts to the defense budget. These cuts are the 'sequesters' you may or may not have heard thrown around in the media. When conceived even those for the BCA didn't actually want it to go into effect. The whole point was to create a timeline for congress and the administration to act and figure out a more sane deficit reduction plan or else.

Point?

The BCA goes into effect Jan 1, 2013 and we still don't have an alternative plan with at least $1.2 trillion in cuts that would nullify it. If nothing comes to pass this November or December we go over.

What happens if we go over?

A lot and a little. The budget and program cuts go into effect, but tax code is largely annual and so if any agreements in 2013 specifically null out pieces of the BCA they'll retroactively effect for the entire year. This may be what ends up happening as a lot of congressmen have taken Grover Norquist's pledge to not raise taxes for any reason. The agreement isn't binding but going against the pledge isn't desired for obvious reasons. Going over includes automatic tax hikes across the board to answer for the more revenue part of the (revenue - spending = ?balanced? budget) equation. Agreeing to something after Jan 1 is in effect a tax cut instead of a tax hike, and as a result keeps true to the pledge even though the result is the exact same figure... politics at it's finest.

Assuming we go over and nothing is corrected the US is looking at roughly $400 billion in increased taxes and $100 billion in decreased spending.

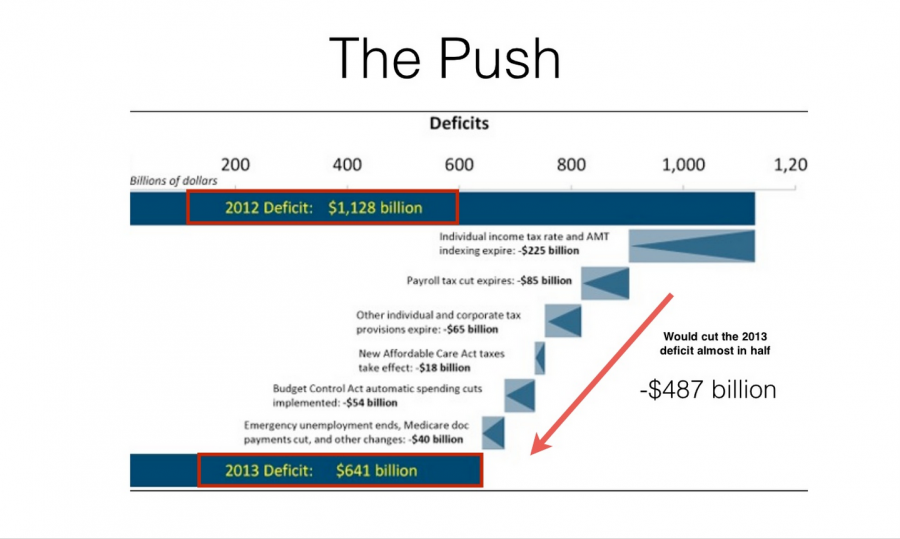

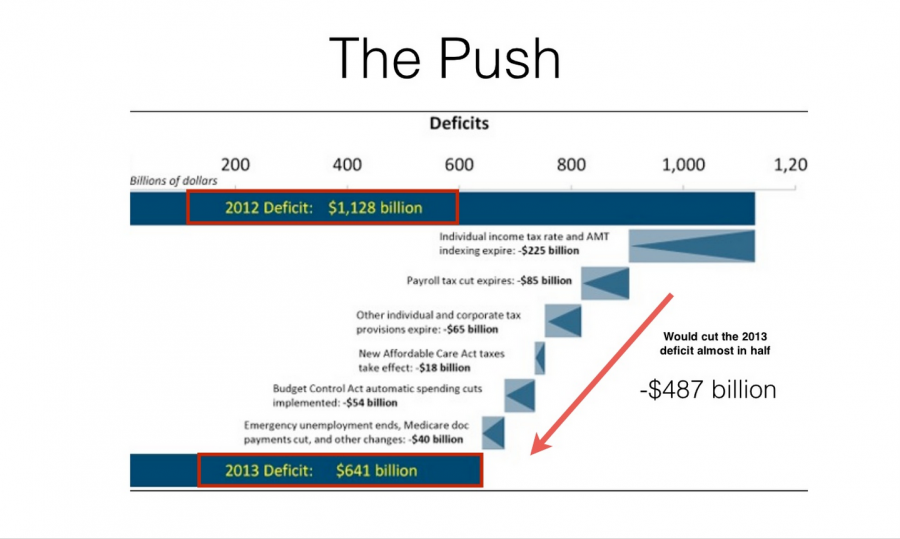

The give and take comes from the following targeted pools:

Note: The BCA is a 10-year-plan. This image shows 2013 only. There is more than this on the table to answer for the rest of that deficit shown but this is what would go into effect immediately.

What options are there?

1. Do nothing and take the plunge. Then fix what doesn't work over the course of 2013.

2. Draft up an alternative budget that meets the 1.2 trillion less drastically and naturally cancels the whole thing. Congress has 2 months to get this done and has virtually no headway on it to this point.

3. Draft up an agreement that kills or postpones it.

The debates and news items you're going to be seeing a lot of will probably focus on 1 and 3. Option 2 is pretty much a lost cause at this point.

How did we get here?

Last year when the debt ceiling was about to be hit and Obama and Congress got into a yelling match about if it would be allowed to raise or not. Ultimately the compromise was Obama would get his debt ceiling raise, but only if the Budget Control Act would be allowed in.

The Budget Control Act (BCA) is full of dramatic cuts that neither side wants, including deep cuts to the defense budget. These cuts are the 'sequesters' you may or may not have heard thrown around in the media. When conceived even those for the BCA didn't actually want it to go into effect. The whole point was to create a timeline for congress and the administration to act and figure out a more sane deficit reduction plan or else.

Point?

The BCA goes into effect Jan 1, 2013 and we still don't have an alternative plan with at least $1.2 trillion in cuts that would nullify it. If nothing comes to pass this November or December we go over.

What happens if we go over?

A lot and a little. The budget and program cuts go into effect, but tax code is largely annual and so if any agreements in 2013 specifically null out pieces of the BCA they'll retroactively effect for the entire year. This may be what ends up happening as a lot of congressmen have taken Grover Norquist's pledge to not raise taxes for any reason. The agreement isn't binding but going against the pledge isn't desired for obvious reasons. Going over includes automatic tax hikes across the board to answer for the more revenue part of the (revenue - spending = ?balanced? budget) equation. Agreeing to something after Jan 1 is in effect a tax cut instead of a tax hike, and as a result keeps true to the pledge even though the result is the exact same figure... politics at it's finest.

Assuming we go over and nothing is corrected the US is looking at roughly $400 billion in increased taxes and $100 billion in decreased spending.

The give and take comes from the following targeted pools:

Note: The BCA is a 10-year-plan. This image shows 2013 only. There is more than this on the table to answer for the rest of that deficit shown but this is what would go into effect immediately.

What options are there?

1. Do nothing and take the plunge. Then fix what doesn't work over the course of 2013.

2. Draft up an alternative budget that meets the 1.2 trillion less drastically and naturally cancels the whole thing. Congress has 2 months to get this done and has virtually no headway on it to this point.

3. Draft up an agreement that kills or postpones it.

The debates and news items you're going to be seeing a lot of will probably focus on 1 and 3. Option 2 is pretty much a lost cause at this point.

![Bovemanx Motorcycle Phone Mount Holder, [150mph Wind Anti-Shake][7.2inch Big Phone Friendly] Bike Phone Holder, Motorcycle Handlebar Cell Phone Clamp, Compatible with iPhone 16 Pro Max Smartphones](https://m.media-amazon.com/images/I/51F+1sontPL._SL500_.jpg)

![Aomiker Motorcycle Phone Mount Holder - [Metal Extension Arm] [Dual Vibration Dampener] Motorcycle Cell Phone Mount, Bike Phone Handlebar Clamp for iPhone 16 15 14 13 Pro Max Plus, 4.7-6.7" Smartphone](https://m.media-amazon.com/images/I/51Yx7gzBJTL._SL500_.jpg)