You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Help Support VMAX Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

ZackDaniels

Well-Known Member

I see this all the time and the household budget comparison is shit for comparisons to government or corporate accounting. It's not at all the same thing as your personal mortgage or credit cards. A lot of debt that the government holds is actually profitable for them to maintain, which is not possible for a household.

From my Fiscal Cliff Explained thread.

From my Fiscal Cliff Explained thread.

Debt is the amount of money owed to itself, it's citizens, and other nations. Debt is not at all similar to personal debt that you and I get from mortgages, credit cards, etc. It's much more like corporate accounting than personal budget. For example when we have $1000 in the piggy bank, and we decide to dip into the piggy bank fund we don't consider it 'debt'. Corporations and Governments need a way to track that so they can be sure they put it back, and so they call it debt.

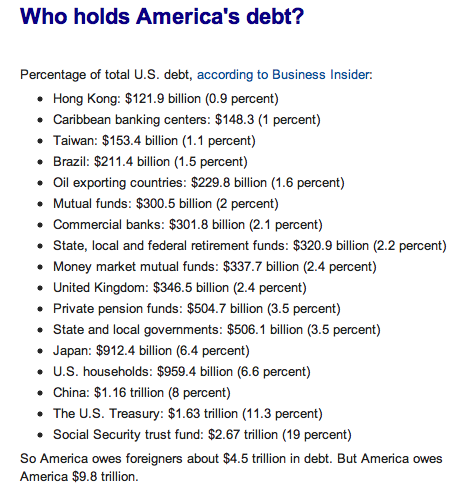

Here's a rough break down (ordered from least to most owed):

The $2.67 trillion in SS are interest free 'IOU' notes to the SS program, from money taken out of its surplus and granted to other programs over the years. Nothing at all like high interest credit cards a household may owe and be scared about. In theory it may never even need to be paid back, but that assumes SS stays solvent and won't ever miss the money missing from it's coffers. That's unlikely.

The $1.63 trillion in Treasury debt are from investors buying Treasury bills, notes, and bonds. You too can own a piece of America's debt by buying a US Treasury Savings Bond they make great Christmas gifts!

This is another significant way Government debt is different from household debt. A government has tools to adjust the inflation rate, and a household does not. When you buy a bond for $1000 you're effectively loaning the government $1000. They add that to their debt, and in 25 years at 2% interest you will be paid back $1,464.13.

The investor wins because they got a rate better than stuffing it in their mattress. The government wins because in 25 years the inflation rate was more than 2%, which means that $1,464.13 in 25 years is still worth less than the original $1,000 was. Households don't get to make money on their debt, but governments do.

Zack I think we would have to add about $50,000 to that house hold budget to cover the money we owe in taxes. wait its more like $50,000 per person in the house hold. even babys. so a family of four would owe $200,000 more. This tax money has gone way up in the last 10 years hell in the last 5 years. I dont feel any safer and my roads still shake the hell out of me. I dont see how we could let this happen to us but we did. And we still let it happen.

[email protected]

Well-Known Member

I see this all the time and the household budget comparison is shit for comparisons to government or corporate accounting. It's not at all the same thing as your personal mortgage or credit cards. A lot of debt that the government holds is actually profitable for them to maintain, which is not possible for a household.

From my Fiscal Cliff Explained thread.

I understand how the "piggy bank" relates to bonds and borrowing from SS but, what about everything else? How is the other 5 or 6 trillion different than regular debt?

ZackDaniels

Well-Known Member

Foreign held debt? It's different because it's exchange rate based. So it depends on a strong dollar. Borrowing a ton to bail out a serious economic retraction to help keep the dollar strong is a bit of a gamble, but the end goal is the economy recovers and the exchange rate for the dollar to pound/yen/whatever is more favorable by the time it needs to be paid back. It's not a good thing to have a lot of, but it's a bad idea to try and solve it while the economy is still fragile because if the solution results in harm to the dollar the government ends up needing to pay back a lot more due to a weakening dollar.

The domestic debt is different because the 2% interest our gov pays investors back is lower than the inflation rate. Thus when it is due to be paid, the money held + interest is actually less money than the original amount. It makes a profit on the money by being able to spend $1000 now, and pay back less than what will be equivalent to $1000 in 25 years.

This is all quite different from household credit card debt, which has interest payments each month and compounds whatever interest isn't paid into the overall bill. The interest rate on all of that debt is typically higher than inflation rates, and so it hurts the debtor to hold it and is best to eliminate it as quickly as possible.

If you want to compare foreign held debt to household debt, the best equivalent would probably be a mortgage. Where the interest is typically less or equal to inflation rates. If you look at all foreign held debt as a mortgage, then the US government's entire mortgage is less than 1 year's salary (GDP and not straight tax income). The rule of thumb for a maximum mortgage a household should endure is 3x annual salary.

The domestic debt is different because the 2% interest our gov pays investors back is lower than the inflation rate. Thus when it is due to be paid, the money held + interest is actually less money than the original amount. It makes a profit on the money by being able to spend $1000 now, and pay back less than what will be equivalent to $1000 in 25 years.

This is all quite different from household credit card debt, which has interest payments each month and compounds whatever interest isn't paid into the overall bill. The interest rate on all of that debt is typically higher than inflation rates, and so it hurts the debtor to hold it and is best to eliminate it as quickly as possible.

If you want to compare foreign held debt to household debt, the best equivalent would probably be a mortgage. Where the interest is typically less or equal to inflation rates. If you look at all foreign held debt as a mortgage, then the US government's entire mortgage is less than 1 year's salary (GDP and not straight tax income). The rule of thumb for a maximum mortgage a household should endure is 3x annual salary.

cgswss

Well-Known Member

Well I stupid so this explains it better for me.

The government takes in $1.00

Obama spends $2.50

Obama raises tases $41

Obama cuts $1

Obama has never had a budget passed.

BUT... Its all someone else's fault.

The government takes in $1.00

Obama spends $2.50

Obama raises tases $41

Obama cuts $1

Obama has never had a budget passed.

BUT... Its all someone else's fault.

Thanks YOU all explained !Well I stupid so this explains it better for me.

The government takes in $1.00

Obama spends $2.50

Obama raises tases $41

Obama cuts $1

Obama has never had a budget passed.

BUT... Its all someone else's fault.

85 MAX-fan

Well-Known Member

Foreign held debt? It's different because it's exchange rate based. So it depends on a strong dollar. Borrowing a ton to bail out a serious economic retraction to help keep the dollar strong is a bit of a gamble, but the end goal is the economy recovers and the exchange rate for the dollar to pound/yen/whatever is more favorable by the time it needs to be paid back.

The value of the dollar has continued to be erroded over the last several decades by exactly this thinking. Also, borrowing to "bailout" aint gonna work, and it isn't intended to. This is a money grab sold to the public as a "fix" for the economy that has been wrecked by the same people selling the "fix". It is this behavior that caused the great depression to last as long as it did. Without the maniacal spending of the governments "new deal" back then the economy would have bounced back much more quickly. In fact it was showing signs of a turn-arround before the massive borrowing/spending were implemented.

It's not a good thing to have a lot of, but it's a bad idea to try and solve it while the economy is still fragile because if the solution results in harm to the dollar the government ends up needing to pay back a lot more due to a weakening dollar.

Sell fear to gain support of more self destructive spending.

The domestic debt is different because the 2% interest our gov pays investors back is lower than the inflation rate.

More manipulation of the value of the dollar to stick the investor (the tax payer).

Thus when it is due to be paid, the money held + interest is actually less money than the original amount. It makes a profit on the money by being able to spend $1000 now, and pay back less than what will be equivalent to $1000 in 25 years.

This is all quite different from household credit card debt, which has interest payments each month and compounds whatever interest isn't paid into the overall bill. The interest rate on all of that debt is typically higher than inflation rates, and so it hurts the debtor to hold it and is best to eliminate it as quickly as possible.

If you want to compare foreign held debt to household debt, the best equivalent would probably be a mortgage. Where the interest is typically less or equal to inflation rates. If you look at all foreign held debt as a mortgage, then the US government's entire mortgage is less than 1 year's salary (GDP and not straight tax income). The rule of thumb for a maximum mortgage a household should endure is 3x annual salary.

Which of course doesn't apply as baseline budgeting GAURANTEES continual spending increases on top of all of the additional give aways and welfare schemes we are forced to swallow. A Mortgage doesn't continue to grow on autopilot, it is continually payed down as long as the payments are made. The US isn't paying down jack, which is why the national debt continues to increase.

Rusty McNeil

Well-Known Member

My only comment is the one about a mortgage rule of thumb.

I don't know how in the hell anyone purchases a home that's three times their yearly income without severe restrictions in their lifestyle or using some really creative mortgage structure.

Generally speaking, principle, interest, taxes and insurance come out at about $1000 a month per $100,000 financed using a conventional 30 year mortgage.

Using the three times rule that means you could afford that $1000 per month on a $33,333 a year income.

That income yields about $2500 a month after taxes. Leaving you $1500 to live on.

Now lets be conservative and say you don't owe anyone a dime on anything.

Budget,

and I'm low balling big time.

Car insurance $200

Utilities. $200

Phone/s $100

Food $500

Gasoline $200

Clothes $50

Household supplies $50

Toiletries $25

Total$1325

Leaving $175 a month discretionary $$ and nothing towards savings or emergency fund.

To say nothing of home maintenance or medical co pays,etc.

That 3x rule and the creative financing people were using to buy more house than they could afford is one of the many reasons so many fail to keep their home.

I think a better rule of thumb is 2x Max and to totally ignore the wife's income in making this equation either. It's a setup to lose a home if one spouse loses a job.

Mine was about 2/3 my annual income, allowed me to put it on 15 years note and not be paying on it till forever.

I don't make that much I just bought a very cheap house, something I understand you can't do in some places cause the markets still very high compared to Texas.

I still don't understand how the hell middle class folks like myself manage to buy any house at all in places like California where the home prices are 2-3 times what they are in Texas, what do they live on after paying the mortgage??? Wages out here aren't THAT much higher than elsewhere in the country.

Financial trickery, creativity and "making it more complicated" of this sort is just more of the same thinking that's got this country in the hole its in.

You'll never convince me fed. debt is a good thing.

If it was then why are so many countries having to be bailed out because they have too much of it?

Or personal debt either. Since my first marriage failed I've been a hard core believer in a Zero debt lifestyle, but then I got married again ; ) so now we have a house payment and my wife's car payment; Everything else, if we can't pay for it we don't buy it. Life isn't that luxurious but its financially worry free and the marriage is better for it.

I don't know how in the hell anyone purchases a home that's three times their yearly income without severe restrictions in their lifestyle or using some really creative mortgage structure.

Generally speaking, principle, interest, taxes and insurance come out at about $1000 a month per $100,000 financed using a conventional 30 year mortgage.

Using the three times rule that means you could afford that $1000 per month on a $33,333 a year income.

That income yields about $2500 a month after taxes. Leaving you $1500 to live on.

Now lets be conservative and say you don't owe anyone a dime on anything.

Budget,

and I'm low balling big time.

Car insurance $200

Utilities. $200

Phone/s $100

Food $500

Gasoline $200

Clothes $50

Household supplies $50

Toiletries $25

Total$1325

Leaving $175 a month discretionary $$ and nothing towards savings or emergency fund.

To say nothing of home maintenance or medical co pays,etc.

That 3x rule and the creative financing people were using to buy more house than they could afford is one of the many reasons so many fail to keep their home.

I think a better rule of thumb is 2x Max and to totally ignore the wife's income in making this equation either. It's a setup to lose a home if one spouse loses a job.

Mine was about 2/3 my annual income, allowed me to put it on 15 years note and not be paying on it till forever.

I don't make that much I just bought a very cheap house, something I understand you can't do in some places cause the markets still very high compared to Texas.

I still don't understand how the hell middle class folks like myself manage to buy any house at all in places like California where the home prices are 2-3 times what they are in Texas, what do they live on after paying the mortgage??? Wages out here aren't THAT much higher than elsewhere in the country.

Financial trickery, creativity and "making it more complicated" of this sort is just more of the same thinking that's got this country in the hole its in.

You'll never convince me fed. debt is a good thing.

If it was then why are so many countries having to be bailed out because they have too much of it?

Or personal debt either. Since my first marriage failed I've been a hard core believer in a Zero debt lifestyle, but then I got married again ; ) so now we have a house payment and my wife's car payment; Everything else, if we can't pay for it we don't buy it. Life isn't that luxurious but its financially worry free and the marriage is better for it.

ZackDaniels

Well-Known Member

Yeah that's about what it looks like. It's the max you should be able to afford and makes you 'house poor', and one of the big signs there was was something amiss with the market before it collapse is that average home sales were well above 3x the average household income. Going as high as 10x in what would become the hardest hit areas of the mortgage crisis.

Those are the flags that tipped the hand that made some very smart people go 'hey... wait a minute?' and they were shouted down with 'it is ok housing prices always go up!'.

:edit:

It's not my rule of thumb. It's an industry one.

Those are the flags that tipped the hand that made some very smart people go 'hey... wait a minute?' and they were shouted down with 'it is ok housing prices always go up!'.

:edit:

It's not my rule of thumb. It's an industry one.

Last edited:

rf900flyer

Well-Known Member

I paid cash for a place that was 70% of my yearly income, @ the time, in 2009. HUD had it and took my offer of 70% of what they wanted which was 64% of what it was taxed @ a yr before I got it. 7 mo after I bought it , I was laid off & didnt see a job for 16 mo. W/ no AC running I kept electric to $30/mo, car ins.$64/mo....and starved my way through. Until May 2011, when I worked again.

It's amazing that the people that run this country are college educated. If I was doing budget cuts. it would be remove secret service protection for all ex-presidents and families.This would basically let the current admin know that they're fair game if they ffff up in office. Also, no raises for anyone in congress and freeze all retirement for these a-holes. They got us into this crap.,,,taking from one budget and supplementing another. Giving this country away w/ NAFTA ,, etc..etc..aid to countries that turn around & spit on us.

The housing BS was also fueled by the feeding frenzy of belief that repainting a kitchen made it worth all soooo much more , etc,etc. I bet Don Vila (?) made a killing w/ his home improvement show. I should've had a show called "this POS mobile home" ..lol..

Bank of America wanted to give me a loan in 2004 for $250k when I took home $450/wk.....WTF??? It was guaranteed failure for me and a bonus for the loan officers.

It's amazing that the people that run this country are college educated. If I was doing budget cuts. it would be remove secret service protection for all ex-presidents and families.This would basically let the current admin know that they're fair game if they ffff up in office. Also, no raises for anyone in congress and freeze all retirement for these a-holes. They got us into this crap.,,,taking from one budget and supplementing another. Giving this country away w/ NAFTA ,, etc..etc..aid to countries that turn around & spit on us.

The housing BS was also fueled by the feeding frenzy of belief that repainting a kitchen made it worth all soooo much more , etc,etc. I bet Don Vila (?) made a killing w/ his home improvement show. I should've had a show called "this POS mobile home" ..lol..

Bank of America wanted to give me a loan in 2004 for $250k when I took home $450/wk.....WTF??? It was guaranteed failure for me and a bonus for the loan officers.

Last edited:

ZackDaniels

Well-Known Member

Financial trickery, creativity and "making it more complicated" of this sort is just more of the same thinking that's got this country in the hole its in.

You'll never convince me fed. debt is a good thing.

If it was then why are so many countries having to be bailed out because they have too much of it?

Or personal debt either.

It's not cloak and dagger to present a nation's economy as something less than simple. Economics of a nation with mixed industry, classes, employment opportunities, localized regulations, imports and exports, financing, and all kinds of other things is in fact... actually complicated.

Here's the problem with zero debt on a fed level.

Worrying only about static cash flow and having a balanced budget year after year leaves a government only as stable as its people. Unemployment goes up then taxes go down and programs important and unimportant alike immediately get underfunded, ineffective, and collapse. This includes having an unfunded military, state governments, and social safety nets like unemployment. Increased civil unrest, foreign opposition, and decreased ability to deal with it. [Doomsday scenario goes here]

There needs to be a balance between the two. So when the economy goes tits up and tax revenues drop we have options to sustain growth, limit contractions, and invest in the people. When an almost unprecedented economic event happens like it did in 2007-08 expect to see a deficit as big as the problem warrants. For the love of god though try to borrow safely and spend wisely. Don't just borrow what's needed against uncontrolled foreign currency that won't work for us, and don't just write no-strings-attached checks to specific markets.

With this point of view in mind I'm totally confused on why we're even talking about reducing the deficit right now. It's a problem better solved when we're in better shape.

I don't need to convince you on a personal level. Seeing as how you have a mortgage and a car payment somebody already has done so. Credit and debt can be good tools, and accelerate growth, but it has to be responsible or it can also accelerate the negatives.

The housing BS was also fueled by the feeding frenzy of belief that repainting a kitchen made it worth all soooo much more , etc,etc. I bet Don Vila (?) made a killing w/ his home improvement show. I should've had a show called "this POS mobile home" ..lol..

Bank of America wanted to give me a loan in 2004 for $250k when I took home $450/wk.....WTF??? It was guaranteed failure for me and a bonus for the loan officers.

Catching reruns of the various reality 'House flippers!' type shows on basic cable after the bottom fell out was something that used to actually make me mad just sitting there in my living room. New paint and appliances shouldn't result in a 100% return in a sane world. Just like bike mods don't give you 100% of their value on resale... sure you can probably get more than you could for a stocker, but not as much as the retail price of all your mods added together. The same is typically true of houses, but the world was so backwards for those few years throwing $1000 freezer boosted resale value $5000. At some point that bubble had to burst, and it did so magnificently.

rf900flyer

Well-Known Member

I would like to know who has any money left from all the profits from the flipped houses and after buying hummers as part of the game. I know of a guy that had an electric co. I guess he was doing well enough to drive (make payments on or payoff?) a $30k "big dog/OCC" bike.....now he's a foreman for someone else, who's been in business since the 70's. Rumor is the business "died" but only the "nose knows" :ummm:

Last edited:

ouchez

Well-Known Member

If you wanna be a free man, do not get in debt, spend far less than you make, and don't play, but into, the consumerism game. This is why my 05 Max is all stock, will not play the negative EV mod monkey game.

O

O

rf900flyer

Well-Known Member

""""It's not my rule of thumb. It's an industry one.""""

so is paying 3x for a home on a 30yr loan

"""This is why my 05 Max is all stock, will not play the negative EV mod monkey game.""""...same here w/ my RF900....mods done by former owners before it went past 7500 mi and my victory ...mods done by former owners before it hit 4100 mi,.,,,and my 94 vmax,,,,needed fork seals...lol

""""If you wanna be a free man, do not get in debt, spend far less than you make, and don't play, but into, the consumerism game."""

You pay for it on a daily basis, w/ sacrifices, but knowing you can go on CL and watch prices drop and then pay cash for something (w/ mods) is a good feeling and you won't have a bill every 30 days in the mail..

so is paying 3x for a home on a 30yr loan

"""This is why my 05 Max is all stock, will not play the negative EV mod monkey game.""""...same here w/ my RF900....mods done by former owners before it went past 7500 mi and my victory ...mods done by former owners before it hit 4100 mi,.,,,and my 94 vmax,,,,needed fork seals...lol

""""If you wanna be a free man, do not get in debt, spend far less than you make, and don't play, but into, the consumerism game."""

You pay for it on a daily basis, w/ sacrifices, but knowing you can go on CL and watch prices drop and then pay cash for something (w/ mods) is a good feeling and you won't have a bill every 30 days in the mail..

ZackDaniels

Well-Known Member

""""It's not my rule of thumb. It's an industry one.""""

so is paying 3x for a home on a 30yr loan

That is the rule I was talking about. :ummm:

I mod the hell out of my bikes because they're not an investment to me. I mod for me and don't really care what it does for or against the value. If I wanted a vehicle for value it'd be some 50's collector muscle car restoration and not a random year Yamaha motorcycle. The max is awesome, but it's hardly an investment in anything but enjoying the fuck out of on-ramps.

That said, I do try and do it intelligently. Such as selling a rare stock piece and getting some generic thing for paint to keep the mod cost as low as possible. That's just good sense... no reason to burn money if you don't have to do it to get what you want.

... Aw crap I started talking about motorcycles again. Where were we? Oh right, it's all Obama's fault because personal finances are totally the same thing as a federal economy and I loves me some higher taxes taken out of my paycheck to solve an imaginary debt crisis. Also, if I were president I certainly wouldn't have cut NASA funding. Obama really fucked up there, and that's why we're in this mess. If NASA still had a solid budget he could have them jettison the nation's poor and lazy into the sun. That's what I would do, and because I have NASA at my back that's as easy as cutting my cable bill from my household budget, because these are the same thing. I don't know why this has to be so complicated when such cut and dry solutions are available.

Similar threads

- Replies

- 7

- Views

- 953

Parts Wanted

Middle drive gear EXPANSION Space and Oil Seal

- Replies

- 1

- Views

- 889