ZackDaniels

Well-Known Member

Now, in Michigan, a teacher with 34 years, Masters Degrees, retires at $34 to $36000 a year,( after also paying into the system) and pays 20% of a lessened health care program, new teachers get no defined pension, and no health care upon retirement.

It is time to treat police and fire retirement and benefits programs in a similar pension and benefit program as teachers, as an example, but they also need to put in the same amount of time, no 20-25 year retirement program.

O

Those numbers just tell me you need to be paying your teachers way more, and not your firemen way less. Breaking 6 figures after 25 years of service to a company shouldn't raise that big of an eyebrow.

A lot of jobs (around here at least) start at 40k. You have to do some hourly retail/fast food to make much less than that. 25 years of cost of living raises and bonuses is almost impossible to find now so I don't really have a private sector comparison, but $17 an hour ($36,000 a year) after 25 years would the problem, and not the $100,000.

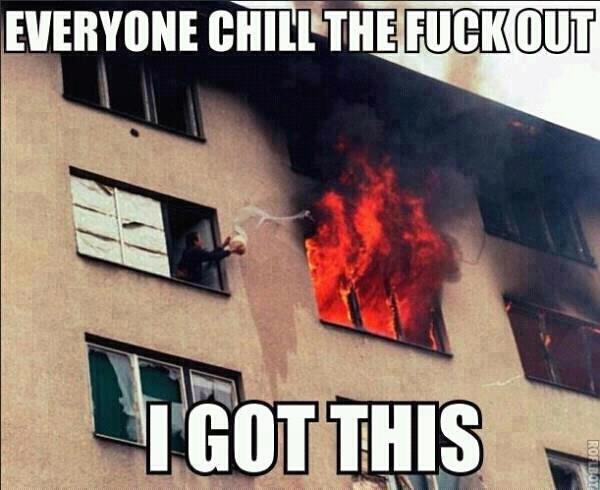

Your property taxes and city sales tax programs pay for firemen among loads of other services usually. The % of your property tax that ends up going to worker salaries is probably among the lowest things on your overall tax bill. This is a fairly silly part of the overall tax code to take issue with, and frankly I'm glad to learn firemen are paid reasonable wages. That means it attracts reasonable people to the job. I don't want a bunch of tards crashing the firetruck into my house instead of putting the fire out.